Who can use Q1?

All investors! Q1 is a totally intuitive, easy-to-use platform that provides consumers with data in one single stock exchange tool, facilitating the analysis and creation of their own investment portfolio tailored to their investor profile.

Is Q1 safe?

Yes. The Q1 has a comprehensive security system that protects data at every level. We use multiple layers of protection, such as microservice isolation and token authentication. We implement OAuth2 authentication and authorization with JWT,

we encrypt all sensitive data and all communications internal and external to our infrastructure. Our priority is to guarantee maximum security for everyone, maintaining the integrity and confidentiality of your data.

How to invest in the stock exchange with Q1?

This tool is still under development! Discover more about our services

here

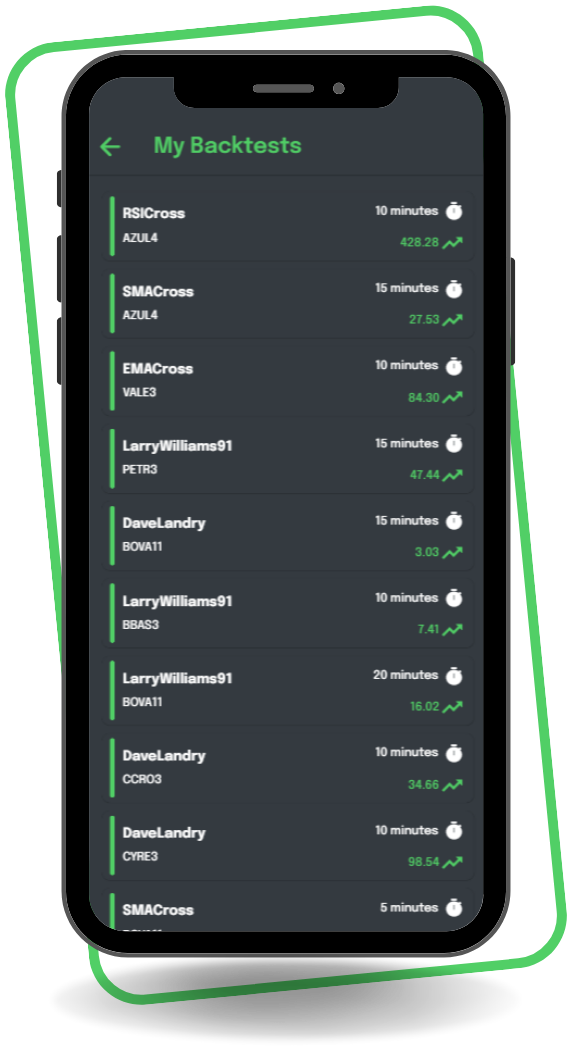

What are investment backtests?

Investment backtests are simulations that allow you to evaluate the historical performance of an investment strategy. Trading strategies are applied to historical market data to see how this strategy would behave in the period defined by the investor. Backtests allow you to analyze metrics such as financial return,

volatility and drawdowns to better understand a strategy's potential before applying it in the real market. The backtests implemented by the investor through Q1 help in making assertive and informed decisions.

What is an investment robot?

An investment robot is an automated software or algorithm that uses artificial intelligence and machine learning to assist in making investment decisions, including buying and selling stocks. These robots are designed to analyze financial data, risks, investment goals and investor preferences,

in order to create and manage a customized investment portfolio. They seek to optimize asset allocation, select suitable investments and perform automatic adjustments based on predefined parameters. In this way, they offer a more accessible, efficient and automated approach to investing,

especially for investors with less experience or limited resources.

How to analyze an asset using backtests?

Backtest results can be analyzed in many ways, but some of the key metrics to look at include total return, annualized return, volatility, maximum drawdown, Sharpe ratio, and Sortino ratio. When analyzing the backtest results,

it is important to observe how the portfolio behaved in different market conditions. The backtest should include several years of market data to ensure performance is consistent over time.